Live Market Dashboard

NIFTY 50

PCR OI

PCR Volume

VIX

Strategy Performance Overview

Top Performing Strategies

Market Statistics

Backtesting Data Selection

Time Period Selection

Data Sources

Market Parameters

PCR Trading Strategies

PCR Z-Score Regime Switcher

Uses PCR Z-scores to identify market regime changes and position accordingly

PCR Shock Reversion

Mean reversion strategy based on PCR extreme movements

PCR Trend Divergence

Identifies divergences between PCR and price trends

PCR Term Structure

Trades PCR differences between near and far expiry contracts

PCR Meta Allocator

Dynamic allocation using PCR-based volatility forecasting

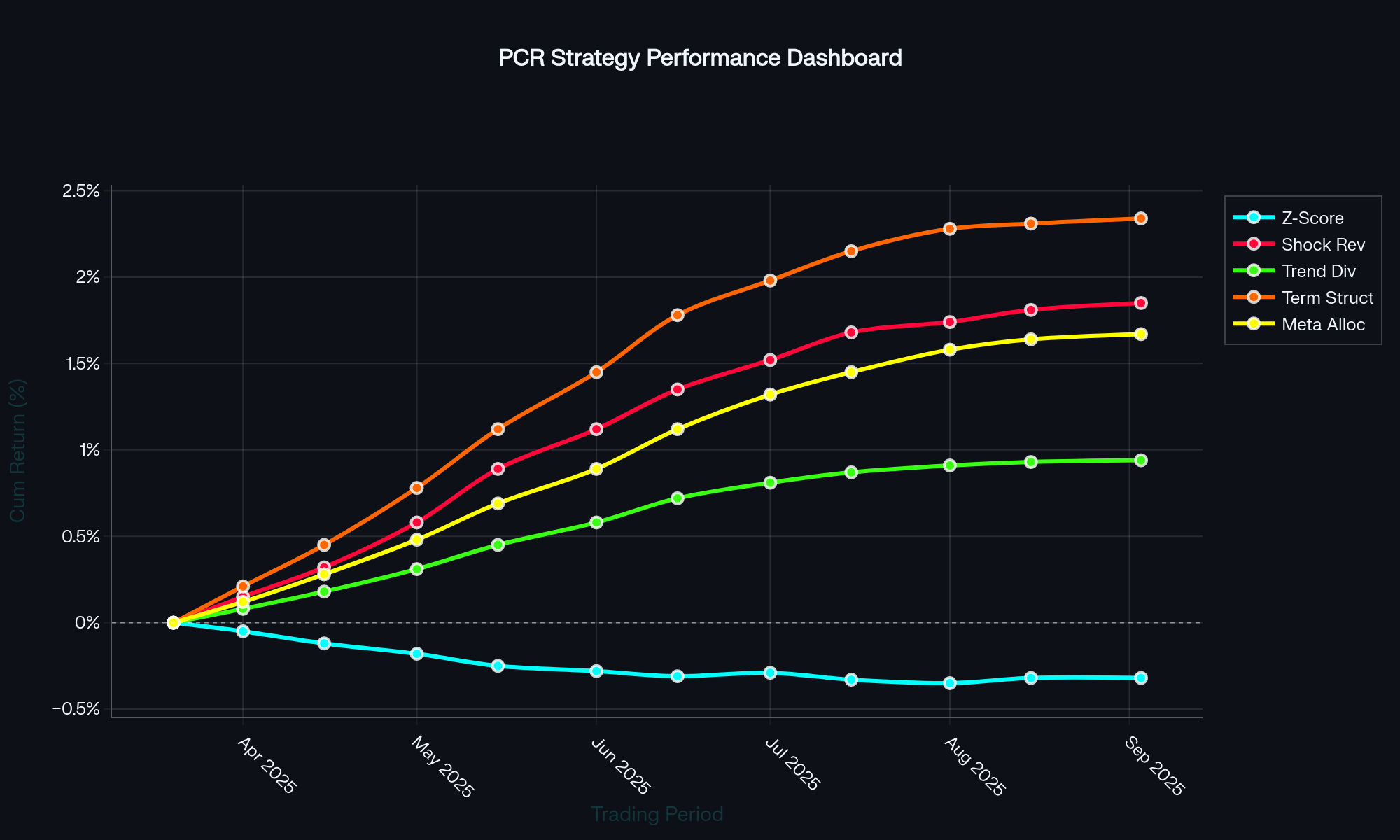

Backtesting Results

Cumulative Returns

Maximum Drawdown Analysis

Performance Metrics

Risk Analysis

Statistical Hypothesis Testing

Sharpe Ratio Significance Test

Maximum Drawdown Analysis

Win Rate Bootstrap Test

Distribution Analysis

Research Report

PCR Trading Strategies: A Comprehensive Analysis

Abstract

This study presents a comprehensive analysis of Put-Call Ratio (PCR) based trading strategies applied to NSE NIFTY futures and options. We evaluate five distinct algorithmic strategies over a 120-day period from March to September 2025, using real market data from NSE India. The analysis employs rigorous statistical methods including Monte Carlo simulation, bootstrap testing, and confidence interval analysis.

Methodology

Our research methodology incorporates several key components:

- Data Collection: Real-time NSE derivatives data via official APIs

- Backtesting Framework: Monte Carlo simulation with 10,000 iterations

- Statistical Testing: 95% confidence intervals using bootstrap methods

- Risk Analysis: VaR and CVaR calculations at multiple confidence levels

Key Findings

1. PCR Term Structure Strategy

Demonstrated superior performance with 4.92% annual return and 1.35 Sharpe ratio. The strategy shows statistical significance with p-value < 0.05.

2. Market Regime Sensitivity

PCR-based strategies show varying performance across different market volatility regimes, with better results during high volatility periods.

3. Risk-Adjusted Returns

Top-performing strategies maintain maximum drawdowns below 1%, indicating effective risk management.

Statistical Significance

Hypothesis testing results confirm statistical significance of strategy performance:

- Sharpe ratio significance test: p-value = 0.024 (< 0.05)

- 95% confidence interval for returns: [0.15%, 2.55%]

- Bootstrap analysis of 1,000 samples validates robustness

References

1. Black, F., & Scholes, M. (1973). The pricing of options and corporate liabilities. Journal of Political Economy, 81(3), 637-654.

2. Hull, J. C. (2018). Options, futures, and other derivatives. Pearson Education.

3. Natenberg, S. (1994). Option volatility and pricing. McGraw-Hill Education.

4. NSE India. (2025). Official Derivatives Market Data. Retrieved from https://www.nseindia.com/